Is Office Equipment Taxable . Web you can claim office furniture and equipment that you use for work, such as: Generally, you have to account for gst. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax.

from www.chegg.com

As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Web you can claim office furniture and equipment that you use for work, such as: Generally, you have to account for gst. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax.

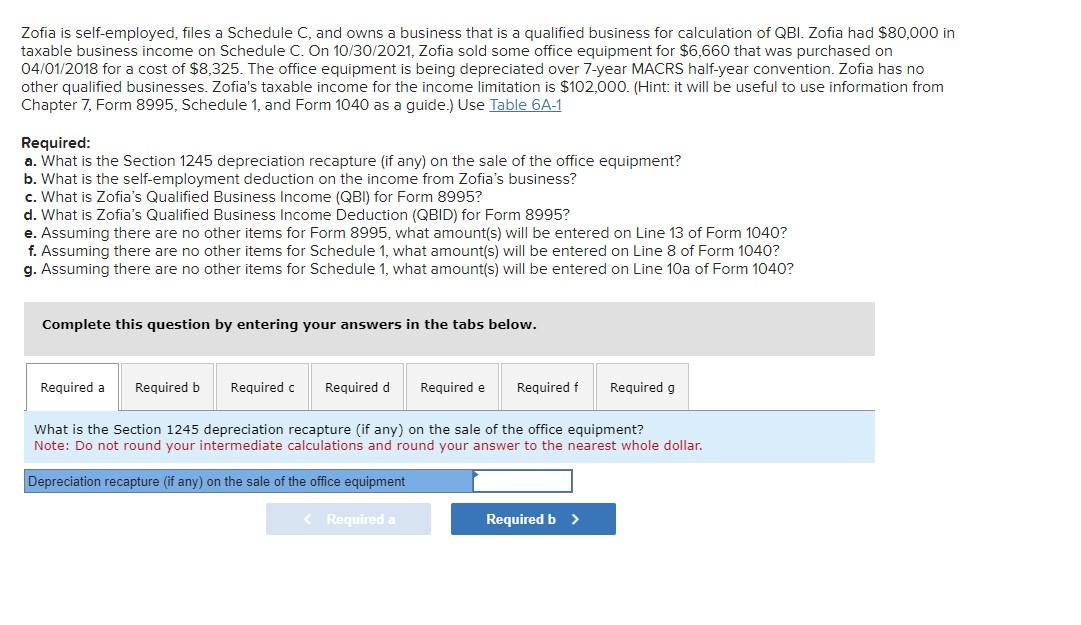

Zofia is selfemployed, files a Schedule C, and owns

Is Office Equipment Taxable Web you can claim office furniture and equipment that you use for work, such as: Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Generally, you have to account for gst. Web you can claim office furniture and equipment that you use for work, such as: Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year?

From www.melaniecurtisaccountants.co.uk

Taxable Benefit Charge Returning Office Equipment Is Office Equipment Taxable Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web you can claim office furniture and equipment that you use for work, such as: Generally, you have to account for gst. As an employer providing homeworking expenses for your employees, you have certain tax, national. Is Office Equipment Taxable.

From pxhere.com

Free Images office, business, paper, brand, cash, document, clutter Is Office Equipment Taxable Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web you can claim office furniture and equipment that you use for work, such as: Web using the figures in the table above,. Is Office Equipment Taxable.

From www.slideteam.net

Office Equipment Quarterly Sales Plan Presentation Graphics Is Office Equipment Taxable Generally, you have to account for gst. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the table above, the rental expenses of s$960,000 recognized. Is Office Equipment Taxable.

From www.thompsontarazrand.co.uk

Taxable benefit charge returning office equipment Thompson Taraz Rand Is Office Equipment Taxable Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Web you can claim office furniture and equipment that you use for work, such as: Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web if. Is Office Equipment Taxable.

From www.chegg.com

Solved U.P.I. Industries Ltd., a Canadian corporation with a Is Office Equipment Taxable As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web you can claim office furniture and equipment that you use for work, such as: Web using the figures in the table above,. Is Office Equipment Taxable.

From www.coursehero.com

Karane Enterprises, a calendaryear manufacturer based in College Is Office Equipment Taxable As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income.. Is Office Equipment Taxable.

From www.chegg.com

Solved Budgeted Statement and Balance Sheet As a Is Office Equipment Taxable As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Web you can claim office furniture and equipment that you use for work, such as: Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the. Is Office Equipment Taxable.

From www.thecopierguy.my

Understanding Office Equipment In Accounting & Tax The Copier Guy Is Office Equipment Taxable Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Generally, you have to account for gst. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. As an employer providing homeworking expenses for your. Is Office Equipment Taxable.

From www.chegg.com

Solved Zofia is selfemployed, files a Schedule C, and owns Is Office Equipment Taxable Generally, you have to account for gst. Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Web you can claim office furniture and equipment that you use for work, such as: Web if you provide equipment, services and supplies to an employee who works from home, you do. Is Office Equipment Taxable.

From simplexmarketing.easy.co

Simplex Marketing Is Office Equipment Taxable Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web you can claim office furniture and equipment that you use for work, such. Is Office Equipment Taxable.

From flssbreanne.pages.dev

Tax Rates 2024 Nsw Dode Nadean Is Office Equipment Taxable Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Generally, you have to account for gst. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the table. Is Office Equipment Taxable.

From www.indiamart.com

SASCO Office Equipment Currency Counting Machines, Automation Grade Is Office Equipment Taxable Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Generally, you have to account for gst. Web you can claim office furniture and equipment. Is Office Equipment Taxable.

From www.pdffiller.com

Medical Equipment List With Pictures Pdf Fill Online, Printable Is Office Equipment Taxable Web you can claim office furniture and equipment that you use for work, such as: As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Generally, you have to account for gst. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web. Is Office Equipment Taxable.

From www.chegg.com

Solved Budgeted Statement and Balance Sheet As a Is Office Equipment Taxable Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? As an employer providing homeworking expenses for your employees, you have certain tax, national. Is Office Equipment Taxable.

From zuoti.pro

0 Required information The following information applies to the Is Office Equipment Taxable Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Generally, you have to account for gst. Web if you provide equipment, services and supplies to an. Is Office Equipment Taxable.

From www.chegg.com

Solved Budgeted Statement and Balance Sheet As a Is Office Equipment Taxable Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Generally, you have to account for gst. Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. As an employer providing homeworking expenses for your. Is Office Equipment Taxable.

From www.amazon.in

Oreva Digit Solar & Battery Calculator Desktop Financial Office Is Office Equipment Taxable Web if you provide equipment, services and supplies to an employee who works from home, you do not have to report or pay tax. Web using the figures in the table above, the rental expenses of s$960,000 recognized in company a’s statement of comprehensive income. Web you can claim office furniture and equipment that you use for work, such as:. Is Office Equipment Taxable.

From www.chegg.com

Solved Budgeted Statement and Balance Sheet As a Is Office Equipment Taxable As an employer providing homeworking expenses for your employees, you have certain tax, national insurance. Generally, you have to account for gst. Web can my company claim 100% of the cost of equipment purchased for chemical hazard control or noise control in 1 year? Web if you provide equipment, services and supplies to an employee who works from home, you. Is Office Equipment Taxable.